The True Cost of Returns

Beyond the Financials

We’ve seen firsthand how returns aren’t just a financial burden for brands—they impact every layer of operations, especially when it comes to inventory management. While most merchants understand the cost of a returned item, they often overlook the immense time and resources that go into handling those returns. From unpacking returned orders to manually inputting tracking numbers into spreadsheets, these tasks can consume significant hours. For retailers processing thousands of orders, this isn’t just a time suck—it’s an operational strain.

But here’s the kicker: returns can confuse a brand’s perception of how much stock they truly have on hand. We see it often with popular products. You may think you have a healthy stock of a best-seller, only to realise a significant portion is tied up in returns. The challenge? Overbuying stock based on flawed assumptions or underbuying because returns data wasn’t factored in. Either way, this leads to inefficiencies, with brands sitting on dead stock or missing out on sales because returned items aren’t back in circulation fast enough.

Dead Stock & The Ripple Effect

One area where we help brands is understanding how their returns rates directly impact purchasing decisions. Let’s say you overbuy and then face a high returns rate. That excess stock now becomes a liability, sitting in your warehouse with no immediate demand. The process of reordering stock or planning for the next season becomes trickier when the numbers aren’t precise. Imagine releasing four dress types, and customers are buying multiple sizes, returning most of them. The stock is essentially tied up, unavailable to others, and by the time it comes back, the window of interest has passed.

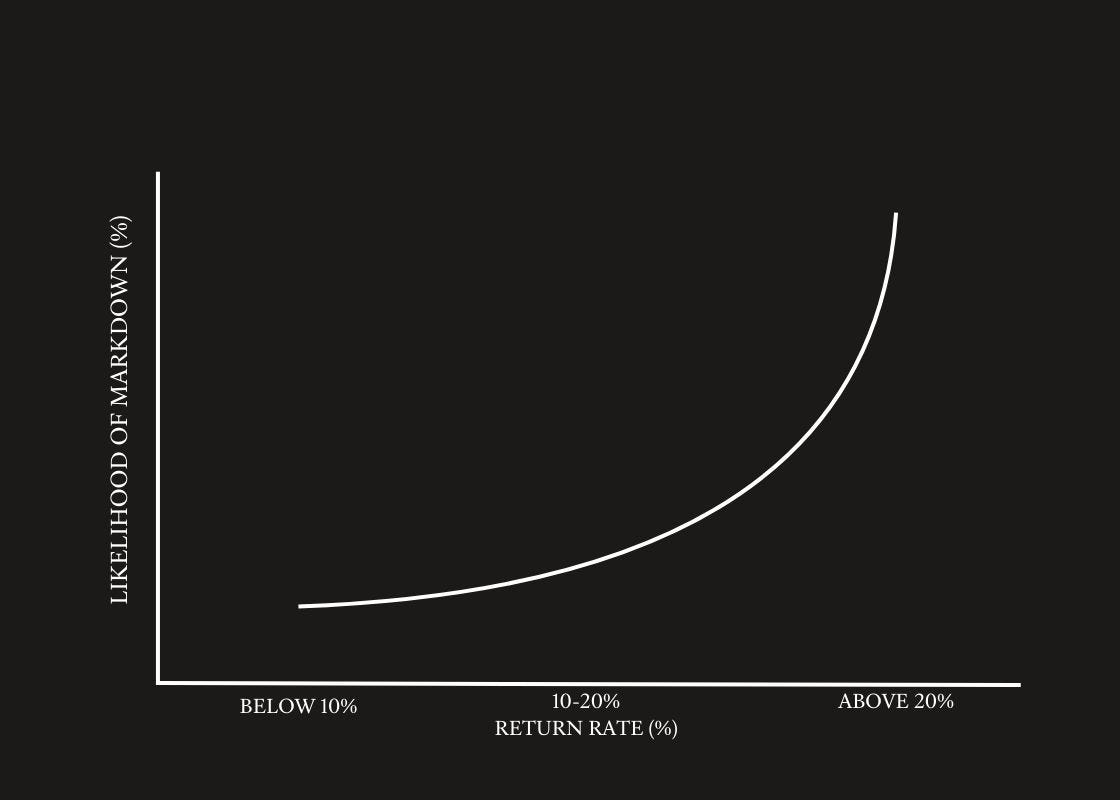

The cost of mismanaging returns doesn’t stop at the warehouse. Dead stock is eventually marked down, eroding profit margins. We've seen that when return rates creep above 10-20%, the likelihood of markdowns significantly increases, compared to a rate below 10%. Every brand has faced this pain: the inability to turn hot products back into sales fast enough, while unsold stock quietly depreciates.

Why This Matters for Retailers

Returns affect more than just your revenue streams—they disrupt your entire operation. Beyond the environmental impact (with a portion of returns never being resold), they cost brands in terms of stock efficiency, warehousing, and most critically, the ability to reorder intelligently. Too often, returns processes are manual, outdated, and isolated, preventing brands from seeing the full picture. That’s where smarter systems come in.

Brands need more than just financial data to fix returns; they need to understand how this impacts their stock lifecycle. For example, bracketing—where customers buy multiple sizes or styles, intending to return most of them—affects your forecasting, reordering, and eventually leads to markdowns.

We push brands to look at returns not as an unavoidable cost but as an opportunity. An opportunity to refine stock management, improve customer retention by ensuring high-demand products stay in circulation, and reduce waste—both in terms of inventory and environmental impact.

Beyond Conversion Metrics: The Power Law

There’s a false belief in retail that more conversions are always better. We see brands obsess over increasing conversion rates (CVR) with free returns, discounts, and heavy marketing spends. But when the focus is purely on converting more customers without accounting for the return impact, this growth is short-sighted.

Brands like ASOS and Boozt have already learned this lesson. ASOS found that 6% of their active customers accounted for £100 million in lost profits due to returns. Boozt discovered that just 2% of their customers caused 25% of total returns. By being deliberate about who they target and refining returns processes, they’ve seen massive improvements in profitability—even without growing their customer base.

The Environmental Cost of Returns

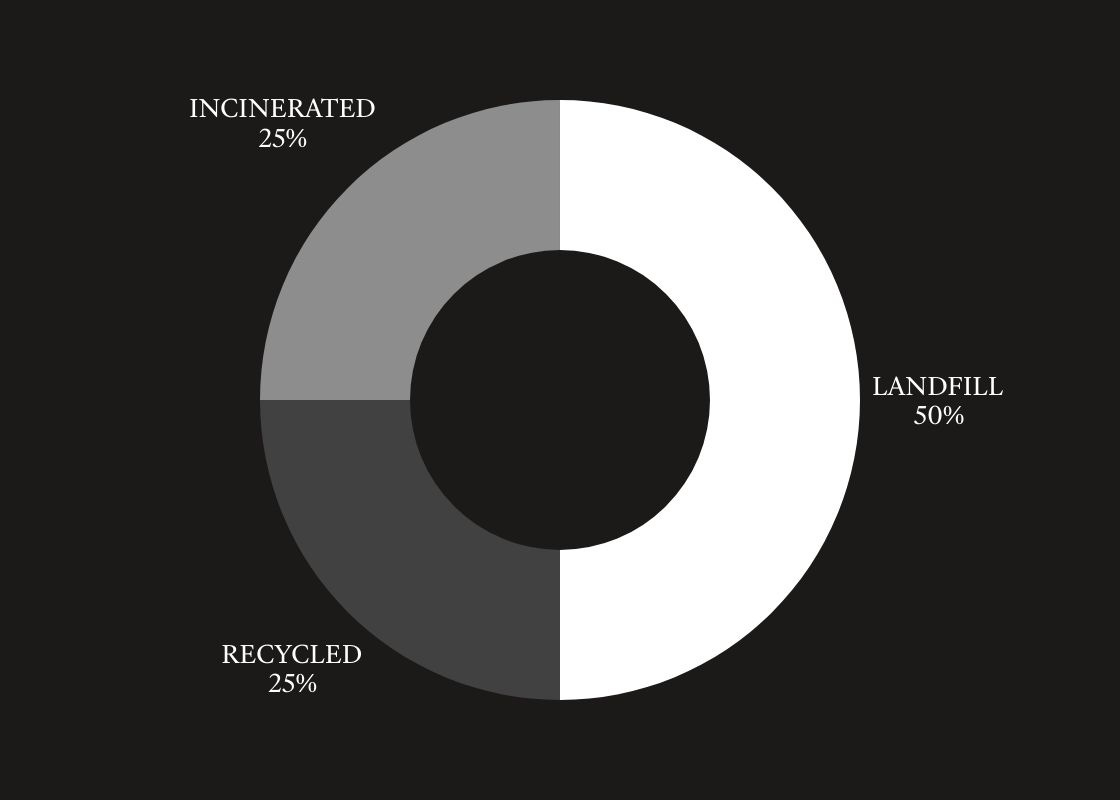

Beyond financial and operational burdens, the environmental cost of returns is staggering. Around 3% of UK returns never make it back to the shelves. Of that, 50% ends up in landfill, 25% is incinerated, and only 25% is recycled. This waste isn't just an eco-crisis—it’s a missed opportunity for brands to resell items and reduce their environmental footprint. Returns caused by poor sizing, bracketing, and impulse buying add unnecessary strain on both the supply chain and the environment.

Brands need to address this issue by implementing smarter returns processes, optimising stock management, and improving product accuracy to reduce returns in the first place. At Commerce Thinking, we help brands integrate more sustainable practices that not only reduce financial loss but also contribute to a more responsible, eco-friendly business model.

Fixing the Problem: Analytics, Sizing, and Paid Returns

The first step to solving the returns problem is understanding the data. As highlighted in our article on using returns data, analytics can be a powerful tool for brands. Tracking returns by SKU, reason, and time frame allows you to identify patterns that might not be immediately obvious. For instance, are certain products being returned more frequently due to sizing issues? Or is quality a recurring problem? Understanding why customers return products gives you the insights needed to fix root causes, rather than simply reacting to the financial impact.

Optimising Stock with Returns in Transit

A key issue for retailers processing thousands of returns is stock visibility—especially for items still in transit. Returns can take days or even weeks to process, leaving stores with incomplete stock data. By utilising returns in transit data, brands can avoid premature cancellations. For example, instead of cancelling out-of-stock orders, brands can track returned items that have been shipped back but are not yet in sellable condition. This system can provide estimated stock levels, ensuring smoother stock transitions and fewer lost sales.

Tools like Loop or Swap can help track items that are either on their way back to the warehouse or have been scanned but not yet restocked. With this reporting, brands can be more agile in managing stock levels. For instance, if a popular product is in the return process, retailers can use that data to hold orders for a day or two instead of cancelling them outright, resulting in fewer lost sales.

Using Analytics to Drive Strategic Changes

Once you have a robust reporting system in place, you can begin to analyse the data to determine what’s working. Tracking not just the volume of returns but how they are processed—exchanges, store credits, refunds—can provide a clearer picture of customer behaviour and help you implement strategic changes. Whether it’s adjusting your inventory forecasts or refining your returns policies, the data you collect can become a crucial asset for long-term stock optimisation.

Improving Sizing Charts

A huge portion of returns, especially in fashion, comes down to sizing issues. Customers bracketing multiple sizes in one purchase is a common practice that leads to high returns rates. Improving your sizing charts can go a long way in reducing this problem. This means not only refining measurements but also incorporating customer feedback and real-world data into your size recommendations. We’ve seen brands who integrate this data directly into their purchasing decisions see significant improvements. Better sizing data leads to fewer returns, less stock tied up, and improved customer satisfaction.

Some retailers are even exploring dynamic sizing charts, where feedback from customers who return items due to sizing inaccuracies gets fed back into the sizing guide itself. This ongoing loop helps refine the sizing accuracy, minimising future returns and, ultimately, protecting your bottom line.

Quality Feedback Loops to Purchasing Teams

Similarly, quality issues—whether perceived or actual—can drive returns. A well-structured feedback loop between the returns team and purchasing is crucial. If customers are citing poor quality as a reason for their returns, your purchasing decisions need to be informed by that data. At Commerce Thinking, we recommend making returns feedback an integral part of the product development lifecycle. This helps the brand address issues before they become costly returns and avoid overbuying low-quality stock that will ultimately be sent back.

Is a Paid Returns Strategy Right for You?

When it comes to paid returns, the decision isn’t always black and white. In some cases, implementing a paid returns strategy can be a powerful disincentive for serial returners. But it’s important to understand your customer base and what you’re trying to achieve. As we discussed in our article on building a paid returns strategy, brands like ASOS and Boozt have seen success by selectively charging for returns to discourage costly behaviour while maintaining flexibility for loyal customers.

However, charging for returns can backfire if not done correctly. For brands with sizing issues or quality problems, a paid returns strategy might push away good customers who are genuinely dissatisfied with the product. In these cases, addressing the underlying issues is more important than implementing fees. The key is balance: identify the customers who are costing your business the most and implement measures that address them directly, whether that’s through targeted fees or adjusting policies for repeat offenders.

Taking Action

Fixing your returns process isn’t about cutting costs at the customer’s expense. It’s about making smart, data-driven decisions that benefit both your business and your customers. By improving sizing charts, creating stronger feedback loops, and carefully considering whether a paid returns strategy is right for your brand, returns are less a headache and more an opportunity for growth.

Want to chat through what goods returns looks like for you? Drop us a line at hello@commercethinking.com