Simplifying DPP for independent brands

Transparency should be a competitive advantage.

When talking with brands - especially those without a dedicated sustainability leader - there’s a lot of confusion around DPP and how to execute transparency. As a result, mistakes are being made and, in a lot of cases, no action is being taken because no one brand-side fully understands the challenge.

It’s clear that, in order for a brand to align on a clear strategy, they need to shut out a lot of the noise surrounding DPP and break the transparency challenge down into smaller, logical steps.

In this article we outline a simple but powerful way to break down the DPP data challenge, to guide brand leaders who are forming their own strategy.

ICYMI

This is article two in a research series focusing on the Digital Product Passport directive within the EU’s proposed ESPR legislation. Through in depth research, close connections with sustainability leaders inside of brands, and engaging with technology & specialist service providers, we’re sharing objective advice for leaders of fast-growing independent brands.

If you’re new to Commerce Thinking, then we recommend starting at article one - Should I care about Digital Product Passports?

Unpacking the different data points

With the DPP directive remaining in consultation phase, we don’t know the definitive list of criteria for digital product passports. However, there’s enough direction for a brand leader to begin mapping out the data-points and gauging the scale of the challenge.

There are essentially four levels of data related to every unit manufactured proposed within the DPP directive. These are:

Product data

All data relating to the product: Article numbers, unique identifiers (EAN), commodity codes, category, descriptions, attributes, colour and similar.

Material data

The composition of the fabric(s), details of treatments (washes, dying etc), where and who sourced and manufactured the fabric, care of fabric, recyclability and the environmental impact.

Asset data

Material and Supplier certifications (GOTs, Fairtrade and so on..), compliance documentations, warranties and manuals

Event data

The journey of the product - from fibre to mill to manufacturing to warehouse to customer to repair and beyond, the list is seemingly endless.

Hypothesis

Sustainability efforts should focus on nailing the product, material and asset level data. Leveraging this level of transparency as a competitive advantage by making consumers feel good and informed about their purchases

Once laid out into four levels it’s easy to see where the hurdles are:

Once a product is at ready to order status with suppliers; the product, material and asset data is largely fixed - although there will inevitably be some changes over time. Furthermore, the data set at product / style level will be shared across many variants and all the units produced.

Event data, on the other hand, must be held for each individual unit and record every transaction or movement of that piece. Therefore, it represents a different paradigm of complexity than the other three data points (which aren’t a walk in the park).

Given the effort required and the little evidence that it has a positive commercial impact for a brand, there’s a big question mark over the business case for event data tracking for a small to medium sized independent brand. The risk : reward ratio on unit level event tracking is a seriously tough sell.

Our opinion is that until legislation is finalised and it’s crystal clear what (if any) relevance the rules have to a business of their size, we believe small to medium sized independent brands (i.e. not publicly traded) should postpone addressing the challenge of event level tracking.

Instead, sustainability efforts should focus on nailing the product, material and asset level data. Leveraging transparency as a competitive advantage by making consumers feel good and informed about their purchases.

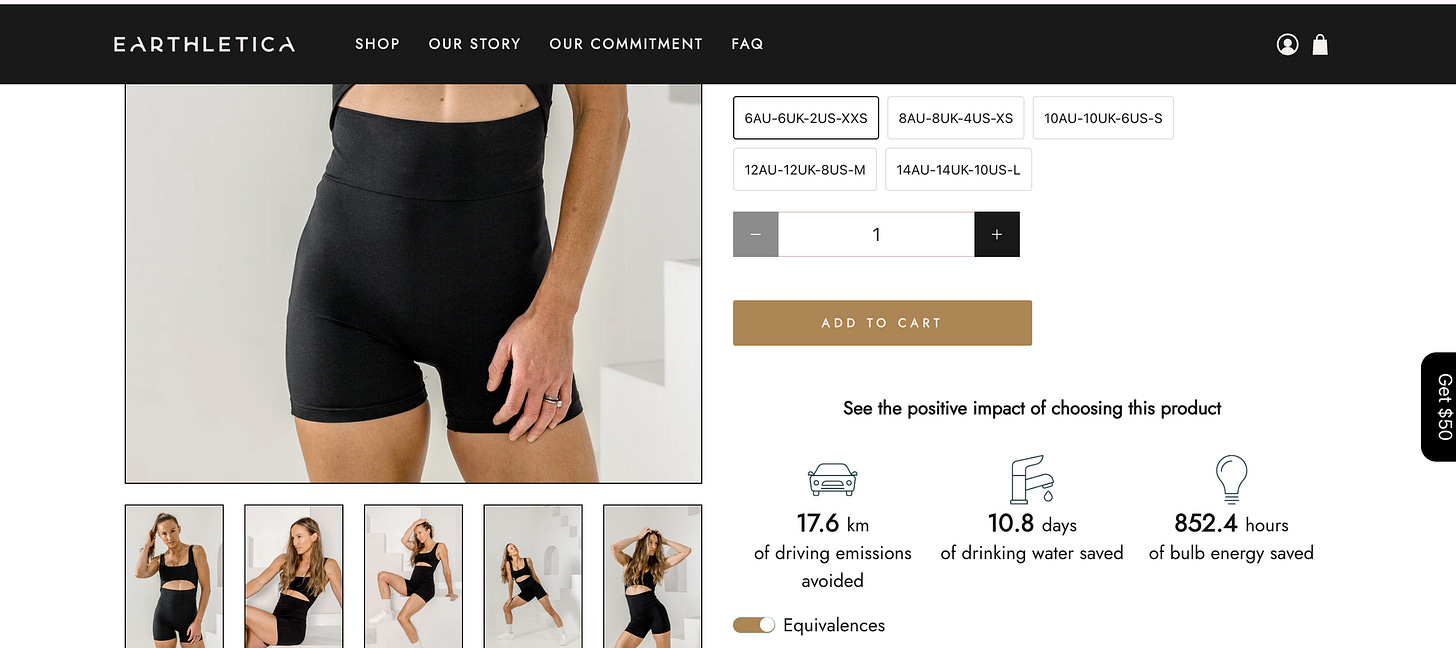

In parallel, they should work with digital teams to publish the information in a sexy way (on product landing pages) so as to drive more engagement amongst customers pre and post-purchase. Examples like Earthletica provide the direction of travel - their use of icons and carbon impact translations communicate transparency in a way the typical consumer can relate to. It’s this type of experience that will shape the way most consumers interact with transparency information.

Simplifying the challenge

A big problem with discussions around DPP is the blending of different objectives and challenges. Put bluntly, a brand can’t solve every element of transparency at once. The challenges are too varied, you have to break it into digestible, logical parts.

For DPP, we suggest brand leaders break down the challenge into:

The four levels of data outlined above; product, material, asset and event

And categorise the outputs into two overarching groups; pre- and post- purchase

Pre-purchase

Pre-purchase is about educating customers ahead of buying your product. Or, put another way, helping consumers feel good and informed about their purchases. This includes:

Product, Material & Asset data published in a consumer friendly way on the website, on the product for physical retail, and available to wholesale customers.

Within pre-purchase, event data is inside a brands control - tracking garment from manufacturer to brand and its onward distribution.

Post-purchase

In post-purchase the aim is to promote responsible use amongst customers. This includes:

Promotion (and, in some cases, facilitation) of resale, repair or recycling of items.

Product, material & asset data published in a consumer friendly way within DPP portals providing care instructions, advice on repair, recyclability, and potentially resale authentication or warranties.

Within post-purchase, event data is outside of a brands control; relying on consumers, resellers or recycling partners to add data on the products use and any repairs.

The case for pre-purchase

We know customers are looking for more sustainable options and an ecommerce store is the primary place they’ll look to suss out a brand’s credentials.

Showing that you have done the work and know where and how products have been made will, in our opinion, be table stakes in the future but right now it’s a way to build strong trust with customers. Therefore, by getting product, material and asset data pulled together and published on your site, you’re making it convenient for consumer to access the information pre-purchase and stealing a march on competitors in the process.

Brands have long used dedicated web pages to communicate their overall sustainability efforts, but now those brands are going to the next level. Showing transparency on the product pages too.

Ganni - recognised as being a leader in sustainable fashion - are now going deeper on transparency with their latest ‘Icon’ range. By partnering with FairlyMade to show the customer exactly where the garment has been manufactured and it’s material assets.

The case for separating out product, material and asset data

This distinction between pre- and post- purchase, allows brands to focus and, crucially, take positive steps forward. Rather than what we see most frequently, which is brands unable to act or take confident decisions because strategy is confused.

Setting aside the bigger ethical imperative of sustainability, there is a clear opportunity for brands to leverage transparency as a competitive advantage pre-purchase. And the threat of DPP legislation may just be the kick up the a**e brands need to start doing the right thing.

By making customers feel better and more informed about their purchases, brands can forge more loyal connections with customers and, thus, grow lifetime value.

Similarly, when there’s so much uncertainty regarding the true impact of DPP legislation on the wider industry it makes sense for brands to focus on what they can control. To this end, much of the product and material data required to deliver transparency to customers will be available within a brand and if it’s not, then it should be.

That’s why we think brand leaders should prioritise making product, material and asset data points available to customers pre-purchase and present it in a sexy way like Asket and others.

With an (intentionally) limited assortment Asket set out to have a fully transparent supply chain and can publish this level of detail on PDPs, others are starting out with just a subset of products (like our Ganni example earlier). Which demonstrates the scale of work involved to get to this point.

The case against event level data

Event data is the standout challenge, because it demands unit level tracking throughout the products journey. Unit level tracking is, to be clear, where each individual unit is tracked; from manufacture, shipped, moved, sold, returned, and resold.

Pre-purchase event level data

If we take the challenge of unit level tracking pre-purchase, it’s an incredibly difficult thing to achieve.

Speak to any merchandiser, logistics team or store manager about specific units and chances are they won’t able to say with certainty that a specific unit is linked to a specific allocation or shipment, or that stock hasn’t moved from store to store or even warehouse to warehouse previously.

Whilst innovations like RFID tags have made unit level tracking better, they’re far from bulletproof. Put simply, there’s not that many businesses set up to track units, so if you’re considering it be prepared - it’s an absolute monster.

Post-purchase event level data

If you think that’s daunting, managing the pre-purchase event data is, however, relatively simple compared to the challenge post-purchase. Which turns is an operational hellscape.

Just take a moment to think about this - how does a brand independently support unit level event tracking post purchase if that involves the owner reselling it via a third party marketplace or flogging it to a friend?

Then, before you sink into a rabbit hole, ask yourself - if a brand provided this capability to customers, how many would actually care enough to keep a track of what they do with stuff they’ve bought?

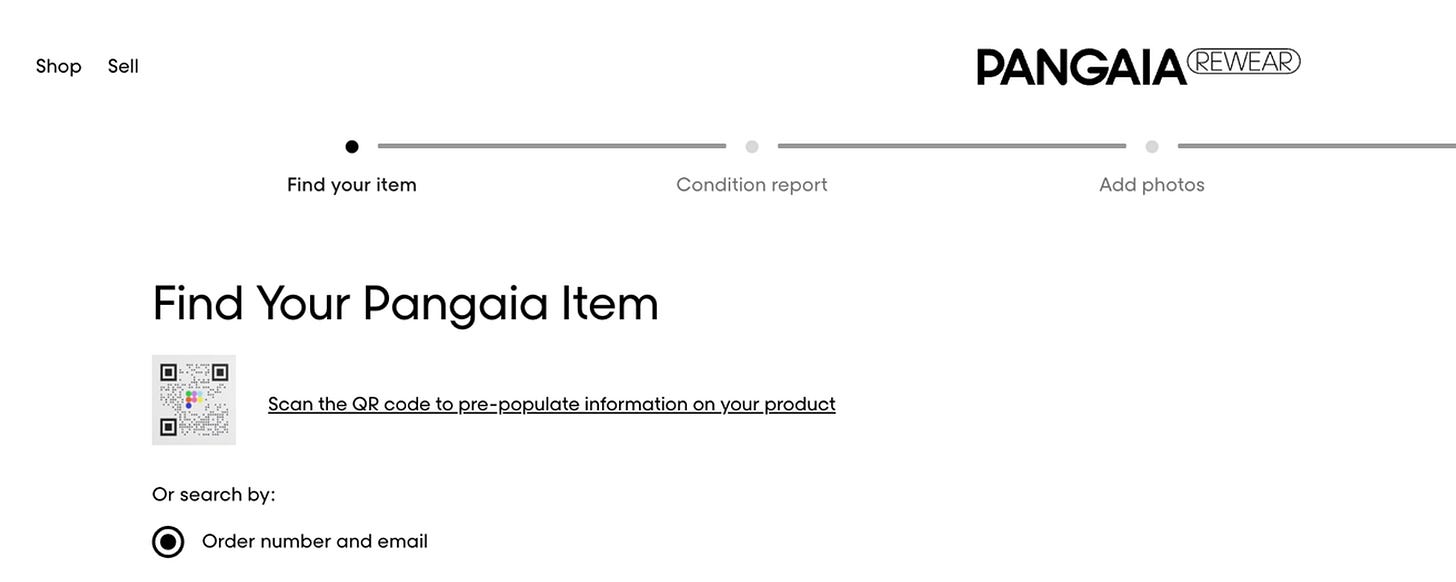

Where the brands are facilitating resale through their own platforms, like Pangaia (rewear.pangaia.com/), they can leverage the digital IDs on products to make it a seamless experience for the customer, but there needs to be value in it for the customer. A quick search on Vestiaire or Vinted (marketplaces that won’t be leveraging Pangaia’s digital ID’s) shows just as many Pangaia items for sale, begging the question ‘what’s in it for me?’…

A lot of noise surrounding event level tracking within DPP blends into broader discussions around the concept of circularity. The notion of event level tracking through a products entire lifespan simply aren’t in the realms of possibility (yet) and feels unlikely to ever happen. To expect consumers to add data, or even a resale or recycling partner with the millions of garments they receive, just doesn’t seem fathomable.

It’s for these reasons, we think unit level event tracking has the furthest distance to travel and, based on our research, seems the most likely element to fail to gain traction. Therefore, for an independent brand considering how best to build a transparency strategy and ready themselves for DPP, they should focus on nailing the other data points before getting sucked into the event data challenge.

Future-proofed effort

The reality is, at the point in which it’s clear that your brand needs to track events in order to meet DPP legislation, you’ll most likely adopt a dedicated tool to provide consumers with a DPP portal that they’re directed to when they scan a QR code on a garment, for example.

In the case of Chloe and other luxury brands using EON powered DPP Portals, the microsites are geared towards resale & care (event tracking post-purchase) or customer experience, giving customers more content and information than could be rendered on product pages within an ecommerce store, be it product story telling or exclusive soundtracks.

These platforms are incredibly powerful but they don’t solve a brands product, material or asset information - they rely upon brands supplying it to them. So getting your primary data in order now will make any eventual move to nailing event data easier.

In the immediate term, for brands not intending to track units at event level pre-purchase, we recommend they consolidate and manage their product, material and asset data within their own infrastructure rather than exclusively inside these dedicated DPP tools.

If phase one of your transparency agenda is publishing detailed info on product, material and assets to your customers then you should host the information centrally and publish it via the landing pages on your store. Whilst it’s true that the DPP legislation may require data to be held on a web portal set up by the EU commission, a brand would be mad not to leverage it on their own ecommerce store. The ecommerce store and compliance portal(s) merely become endpoints receiving the data.

Where and how to manage the data collection, storage and syncing to various endpoints is an area we’re going to unpack in detail in our next articles within the series (so stay tuned).

More thoughts

There’s an interesting podcast with the team behind Trace4Value/Kappahl pilot mentioned above, that unpacks the process they’ve gone through to establish this iteration of a DPP and the parts they have, for now, excluded due to the complexities. They have also published a data protocol that details the 100s of data points referenced, all referencing product, material and asset data. Our POV is simple, unless you plan to include event data per unit then there’s little value in hosting it offsite.

Current iterations of DPP portals are not maximising the opportunity for brands. If/when a consumer scans a QR code on the product, sending them to a siloed dpp website (like this example) containing the product, material and asset information is a missed opportunity…

We’ve gone deep in our research, but some things still elude us. If you’re an expert in DPP legislation and have answers then I’d love to hear from you:

What exactly is meant by decentralised data when referenced in the DPP consultation?

Is event tracking expected only on finished goods, or does it include the raw materials through to finished goods?

Want to talk?

Book a call with Luke at Commerce Thinking to learn more about how brands can prepare and execute a transparency strategy by clicking here.