2 mins on... Shopify's Sales Report

Your actuals are going to be different from Shopify Analytics. If they’re not, you’re basing your decisions on misleading actuals.

How many times have you heard the phrase “those numbers don’t match what we’re seeing in Shopify”?

How many meetings have been derailed due to mismatches in numbers between different reports?

How many people in Finance spend half their lives chasing the real numbers?

A lot of this drama is down to misuse of Shopify’s standard Sales reports and there’s simple steps you can take to free yourself from the situation. As with any challenge, the first step is accepting you have a problem.

Brand leaders and operators commonly assume that the numbers in these Shopify reports are the truth against which everything else is compared. This is wrong because:

Shopify’s standard Sales reports use a different definition and calculation of KPIs to what most serious brands need

Most brands haven’t got defined KPIs that everyone and every system is aligned to… Meaning no one really knows the truth.

This combination is leading to dreadful weekly trade meetings, days of wasted time comparing figures in different systems with no path to an answer, and a general lack of trust in numbers leading to delays in key decisions.

In the next 2 minutes you’ll read:

A teardown down of the problematic definitions used by Shopify in its standard Sales reports

Rules for a happier life

A list of the KPIs your business needs to define for itself - then align everyone in the business to (because if you don’t you’ll never know the truth)

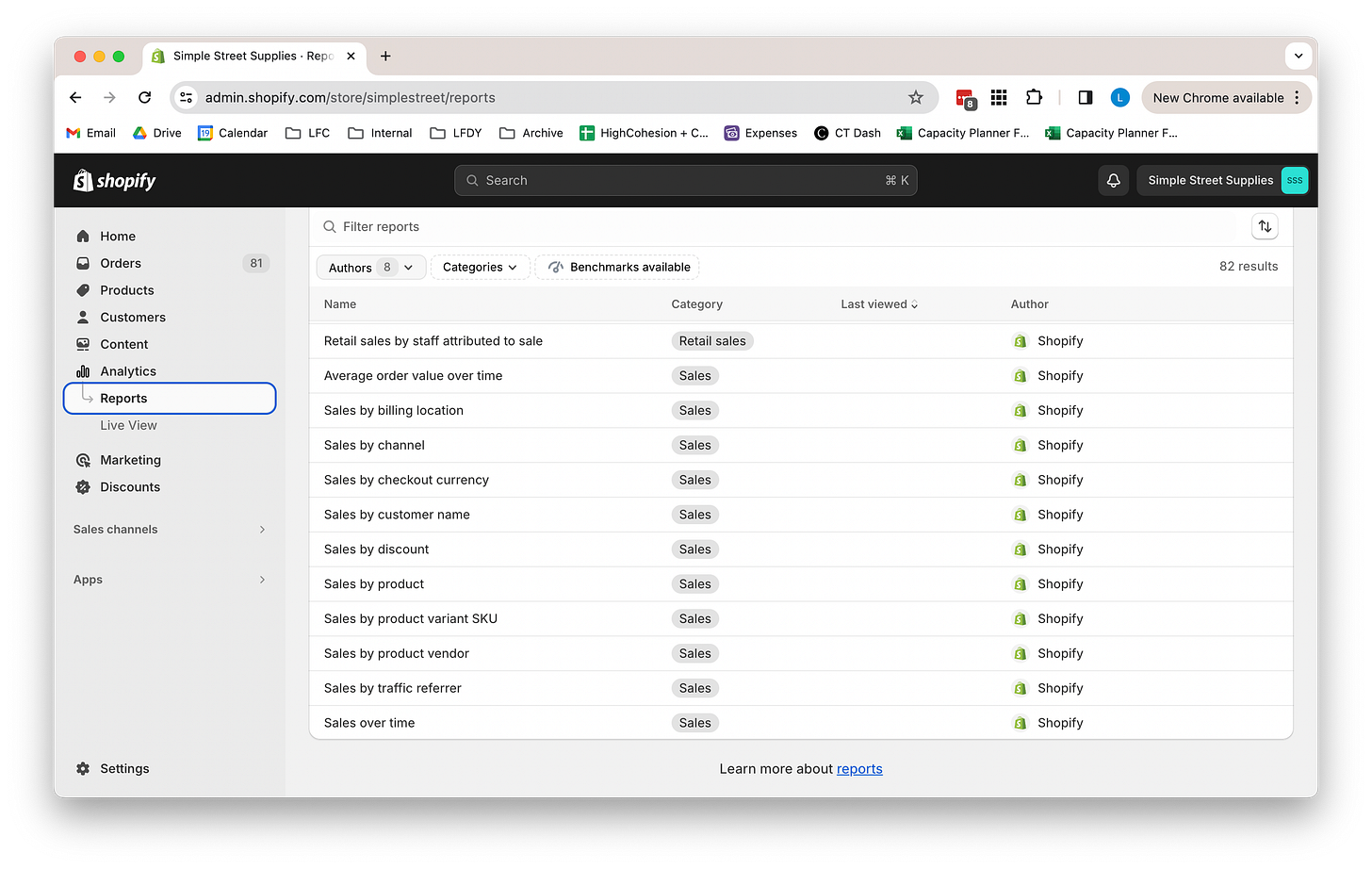

A Teardown of Shopify’s Sales Reports

Shopify Analytics are incredibly useful reports, but they can be dangerous if you don’t understand the context behind them and are using them to drive all or most of your decision making.

In this section we’re going to pick out metrics recorded in Shopify Sales reports that are misleading in the context of most serious brands.

Gross sales

Definition: Equates to product price x quantity (before taxes, shipping, discounts, and returns) for a collection of sales over a given time period. Canceled, pending, and unpaid orders are included.

Issues:

This often catches people out and can distort figures. Imagine you use a finance tool like V12, Shopify will include orders that have yet to be and may never be approved in your gross sales figures even though you will never actually make that sale. The inclusion of canceled, pending and unpaid orders creates (in lots of cases) an unnecessary question mark on your numbers.

Test and deleted orders are not included. This is reductive, as often test scenarios (e.g. new payment gateway, new integration) involves creating what Shopify would classify as a real order, therefore, your gross sales figure is going to be inflated.

Also, often brands use orders in Shopify to reserve stock for influencers or retail stores - irrespective of whether these are processed with zero or a 100% discount - and these are pulling into gross sales. Thus skewing profitability figures and/or discount volume.

Discounts

Definition: Equates to line item discount + order level discount share for a collection of sales.

Issues:

This is a single figure that you can’t dissect, and, therefore, strips it of any real value when it comes to decision making.

Returns

Definition: The value of goods returned by a customer.

Issues:

This is a misnomer because it really means refunds, not necessarily a physical return of goods (e.g. if you refund a customer as a gesture of goodwill but don’t require customer to send anything back this will show in the Returns figure on Shopify).

Net Sales

Definition: Equates to gross sales - discounts - returns.

Issues:

This doesn’t include shipping, which for many brands means there’s a big gap in this revenue number

Which can have a huge knock-on impact on the P&L if Shopify’s Net Sales figure is the net revenue figure in your brand.

Shipping

Definition: Equates to shipping charges - shipping discounts - refunded shipping amounts.

Issues:

From a purely financial perspective this makes sense, however, on virtually every other level it skews things favourably or unfavourably.

For example, if you’re in a low sales month immediately following a peak sales month, the refunded shipping amounts are going to present at a much higher rate. However, that doesn’t (necessarily) mean you have a problem, despite the Shopify figure looking alarming in month because relative to the number of orders in the previous month it’s a totally acceptable return rate… Again, the number isn’t wrong it just lacks crucial context.

Tax

Definition: The total amount of tax based on product tax rate + shipping destination tax rate across all orders in a specific time frame.

Issues:

This can differ to the tax figures in back office systems (like ERP) where penny rounding issues are common, it’s likely to be negligible.

Finance departments have to get comfortable with these penny rounding discrepancies.

Total sales

Definition: Equates to gross sales - discounts - returns + taxes + duties + fees.

Issues:

Total sales will be a positive number for a sale on the date that an order was placed, and a negative number for a return on the date that an order was returned.

This is important because it doesn’t accurately represent the rate of order refund and distorts the commercial impact relative to time. Your rolling actual return and refund rate will be a much smoother line than what Shopify Analytics presents.

Average Order Value

Defnition: Equates to gross sales - discounts / number of orders.

Issues:

Again, because this uses the gross sales figure it doesn’t contain shipping charges, which can skew the figure significantly.

Gross Profit

Definition: The total profit made on the product during the time period of the report. It's calculated by subtracting the product cost from the net sales.

Issues:

The cost price figure assigned to an item in Shopify is (in the overwhelming majority of cases) not a reliable figure. It’s commonly empty, FOB at best, and not regularly updated. So, unless you are an incredible outlier, relying on Shopify for margin and profit reporting is a non-starter.

Rules For a Happier Life

Your actuals are going to be different from Shopify Analytics. If they’re not, you’re basing your decisions on misleading actuals.

Shopify Analytics will sit in isolation to your internal targets and budgets, you need to get the raw data out of Shopify and into something that can compare its figures against your projections/targets. For most brands this is still done largely in excel or Google Sheets.

The way KPIs are calculated in Shopify Analytics is an aggregate and it’s not tailored to you so you can’t treat it as gospel truth.

As soon as you extract data from Shopify and begin slicing in ways that you can’t do in Shopify Analytics (which is inevitable because it’s limited), the figures are no longer going to be aggregated in line with Shopify Analytics so they will be different… Remember, that’s a good thing.

The KPIs Your Business Needs to Define For Itself

The sheer amount of time and energy spent contesting numbers inside of brands is huge when they have no underlying definition that everyone is aligned to. Finance legitimately want one thing, marketing want another, buying and merch want another, and before long no one knows which way is up or down.

There’s usually some over worked excel junkie getting pulled from pillar to post… So do everyone a favour, define and ensure everyone follows the same business logic across these KPIs:

COGS

Gross Revenue

Net Revenue

Discounts: Discount Code, Markdowns, Promotions and Gesture of Goodwill

Margin: GP1, GP2, GP3, GP4

Monetary Value

Percentage

Stock Units

Stock Value

Stock Cover

Aggregated Total Performance Marketing Spend

Aggregated Return On Ad Spend

Returns

Refunds and Adjustments:

Recognising refunds within the time period they were made (Avoiding distorting your commercial performance due to a raft of refunds being processed on orders from a previous period) e.g. A backlog of refunds are issued around xmas and NY relating to BFCM sales, the cash out in that week may put the commercial performance could put the business on negative even when sales is strong.

AND Recognising refunds against the time the order was placed (Ensuring you get a accurate retrospective)

Rolling 60 day Refund Rate: Benchmark expected refund volumes in past 30 days against the volume of units sold, cash value or both from -60 to -31 days. This allows much greater context to be baked into refund analysis.

This plays a key role in forecasting restock numbers because it enables you to apply a much more relevant % of likely return, thus factoring this into replenishment numbers